The British Pump Manufacturers Association has for a number of years enjoyed a close working relationship with European Industrial Forecasting Ltd, and in this article, Vivian Woodward of EIF, presents his forecast for the UK Pump market for the period 2015-2019.

Historical Market Size and Growth - Long-Run Trends

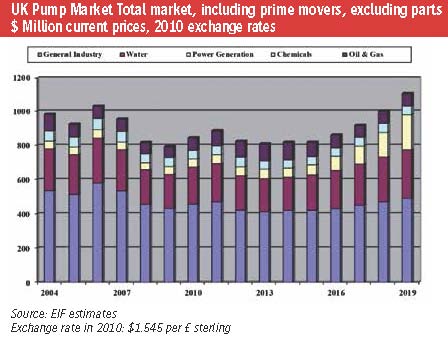

Market size averages around $1.5 billion per year (around £975 million at 2010 exchange rates), with parts and repair accounting for almost 39% of the total. Overall market growth is relatively slow and dependent on replacement demand because the installed base is large in relation to the need for expanded plant capacity. Replacement demand is therefore much more important than suggested by parts and repair, and may account for as much as 75% of the market.

Although overall market growth is slow, there can be shifts in the structure of demand because of changes in the relative growth rates of different end uses. For example, public sector construction resulted in a huge growth of demand since 1997 owing to the election of a Labour government, but has now been cut back. The rapid build-up of chemical plant capacity in the Middle East and Asia has adversely affected investment in the UK chemical industry. Also, the rapid development of shale gas/oil in the USA has resulted in a major gain in the competitiveness of USA chemicals relative to the UK and the rest of Europe.

The Importance of Exports and Imports

Exports probably account for around 60% of sales, although measurement problems prevent a clear comparison of exports with the level of total sales. The pattern of exports by destination 2003-2014 (see table) shows some marked changes. Exports grew by 7.4% per year 2003-13, compared with 5.7% per year for imports. Exports fell by 4.4% in 2014, whereas imports grew by 8.1%.

On the export side, the leading markets are USA, Germany, France and China. The fastest growth rates 2013/2003 were recorded for South Korea, Russia and China; but in 2014 there were large falls in exports to all three destinations. In addition exports to the largest market, the USA, also fell.

On the import side, Germany accounted for 27% of the total in 2014. Other large suppliers are the USA, Italy and France. In 2014 there were notable increases in imports from the Czech Republic, and Hungary, as well as from China and Japan.

Future Prospects

The last two years have seen stagnation in the UK pump market and prospects for 2015 are hardly better. This is the result of a slowdown in the growth of world trade 2013-15. Recovery from the 2008/9 recession, which was seen 2010-12, was not sustained. Similar trends can be observed for Europe as a whole. General recovery is expected from 2016 onwards.

The recent collapse in oil prices has had a marked effect on investment in the North Sea. Another recent trend is the strong dollar appreciation, which can be expected to boost pump production in Europe relative to the USA. Although growth in China is slowing it is expected to remain above 6% a year. A collapse of the Euro has been averted, at least in the short-term, thanks to the quantitative easing by the European Central bank. However, it remains to be seen whether the Euro can survive in the longer term.

Our forecast assumes that the Euro will survive over the next five years, but that growth will remain subdued in the Euro area relative to the UK. Gains by the Scottish National Party in the recent general election indicate that more transfer of fiscal affairs will be carried out, if not a move towards outright independence - but we have assumed the UK remains intact. For the UK, the chart shows a sharp fall in the pump market (excluding parts and repair) 2008-9. Although there was a recovery in 2010/11 this was not sustained. Market size will not achieve the peak reached in 2006 until 2019.

The end use sectors hit hardest by recession were chemicals and general industry. Within general industry, demand from construction related sectors, such as building services and construction dewatering, were worst affected and some recovery is now underway. Housebuilding is expected to be a major growth area. Power generation is the only end use sector expected to grow significantly relative to other sectors, owing to the urgent need to replace existing coal and nuclear plant capacity. However, construction has only recently been authorised for new nuclear power plants, a delay of over 10 years, and financing is proving difficult. New gas-fired power plants may therefore prove to be essential in the short-term.